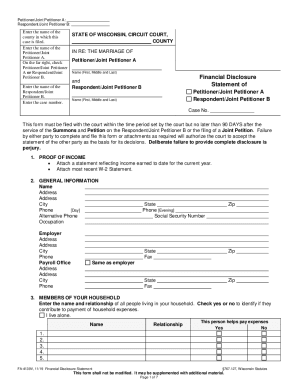

What is a Wisconsin Financial Statement Form?

A Wisconsin Financial Statement is the form that was created to serve as an outline of and the financial situation of an individual residing in the State of Wisconsin at that moment. Typically, this document is necessary for individuals applying for a bank loan, mortgage or other credit, as they are required to provide adequate documentation so that the bank can consider the application and make a reasonable decision about its approval or rejection.

An applicant’s financial position will be evaluated based upon the information they claim on the Wisconsin Financial Statement Form.

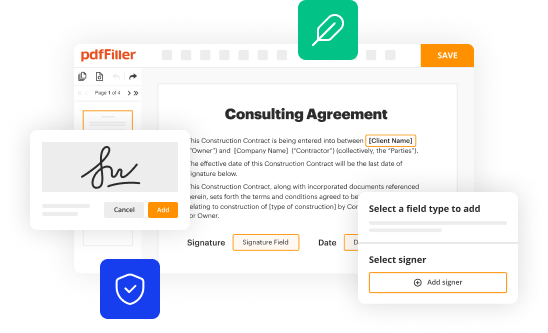

An applicant may apply for an extension of credit individually or jointly with another applicant.

Is the Wisconsin Personal Financial Statement accompanied by any other forms?

As mentioned in the body of the form, it is mandatory that the applicant attach a statement reflecting income earned to date for the current year and their most recent W-2 Statement.

When is the WI Financial Disclosure Statement due?

The applicant for a credit and the bank to which he is applying for credit should agree upon the date of furnishing the financial statement.

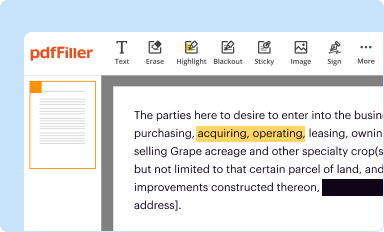

How to fill out the WI Financial Disclosure?

To properly fill out the form, the following information is required:

Personal information: name, address, social security number, information about you current and previous employment, dependents, marital status;

Assets: cash; securities; life insurance cash value; mortgages and contracts held by you; homestead; other real estate; profit sharing & pension; retirement accounts, including IRA accounts; automobile; personal property; and other assets.

Liabilities: short terms notes due to financial institutions; short term notes due to others; credit accounts and bills due; insurance loans; installment loans and contracts; mortgages on home; mortgages on other real estate; taxes; and other liabilities.

The applicant should also provide information about their annual income, including salary, bonuses, commissions, dividends, interest, net real estate income. This is why the corresponding attachments are required.

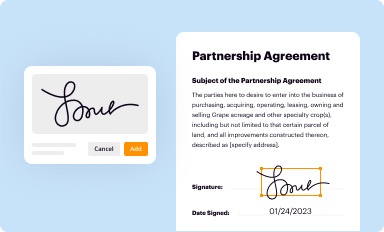

Finally, the Statement should be signed and dated.

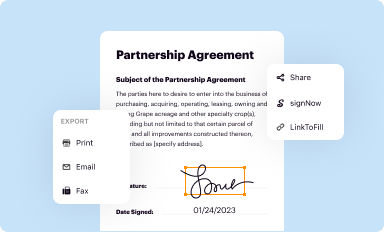

Where do I send the completed Personal Financial Statement?

You should send your Personal Financial Statement to your bank.